Vol. 2025, Issue 10 - Builders Outlook

The Fight for Housing Affordability:

The Fight for Housing Affordability:

Housing affordability continues to be a challenge in every corner of the country. A lack of housing supply is a key component to this challenge, but policy mandates exacerbate the issue by making it more expensive and more time-consuming to build homes.

NAHB CEO Jim Tobin recently appeared on the Builder Straight Talk podcast to highlight the hurdles builders face in the current market, and how the Federation is working at the local, state and national levels to address them.

“Homeownership is the gateway to the middle class in this country, and we are pushing homeownership farther and farther away from the next generation,” Tobin shared with podcast host Michael Krisa. “The more we do that, the harder it is for them to build equity, build real wealth in this country. The housing crisis has catastrophic downstream effects that we have not felt yet for the next generations behind us.”

Hurdles include:

Energy Code Mandates

Mandates from the Department of Housing and Urban Development (HUD)and Department of Agriculture (USDA)for new homes financed through certain federal programs comply with the 2021International Energy Conservation Code(IECC) add tens of thousands of dollars to the cost of a new home.

If the focus is truly on energy efficiency, Tobin suggested, policymakers should be turning their attention to the 130 million homes — roughly 90% of the nation’s housing stock — that were built before 2010 and less efficient that the homes being built today.

Local Impact Fees and Other Upfront Taxes:

Rather than raise property taxes, which affects current home owners, local governments often turn to impact fees and permitting costs to generate revenue, which raises the costs of new homes and puts them out of reach.

Labor Shortage:

There’s a monthly shortage of roughly200,000 construction workers, and builders will need to add 2.2 million new workers over the next three years to keep up with demand. To help bolster the construction workforce, there needs to be a mindset shift in how we approach and value the trades.

“It’s [changing the] hearts and minds of students, guidance counselors who are oftentimes reviewed on how many kids they send to four-year institutions, and more importantly, parents to tell their kids, ‘Hey, you don’t have to college to be successful in this country,’” he noted.

NAHB constantly advocates on behalf of its member at the local, state and national level to address these and other key issues, and Tobin values the ability to share builders’ perspectives with policymakers on Capitol Hill.

“The builders are all facing the same issues — degrees and difficulties are different, but the same issues,” he noted. “And I want them to be able to touch and feel NAHB to know that we're there to support them.”

Learn more about NAHB’s blueprint to tackle the housing affordability crisis at nahb.org/plan.

2025: A Mixed Bag

Growth Amid Uncertainty Propels Our Industry Forward

As we approach the end of another year, I want to take a moment to reflect on what has been both a rewarding and challenging time for our industry here in El Paso. First, I want to extend my sincere gratitude to all our members, partners, and community leaders who continue to show incredible dedication to building quality homes and strengthening our city. Your hard work, collaboration, and resilience are what make the El Paso Association of Home Builders such a strong and respected organization.

This year has brought both growth and uncertainty. One of the biggest concerns we are seeing right now is the impact of the federal government furlough. As many of us know, El Paso’s economy is deeply connected to government employment, whether through Fort Bliss, border operations, or civilian agencies. The temporary halt in pay for thousands of local workers creates a ripple effect across our community, from delayed home purchases to slower consumer spending.

For our builders and real estate partners, this means some of our potential buyers are pausing their decisions or facing delays in mortgage approvals and closings. Lenders are tightening timelines, and customers are understandably more cautious with their finances. It is a reminder of how interconnected our local economy is and how quickly national events can impact our region.

Despite these challenges, there is a great deal to be optimistic about. El Paso continues to experience steady growth, and our builders remain committed to innovation, quality, and affordability. We have seen encouraging momentum in local housing starts and a continued demand for new homes as families choose to put down roots in our community.

As we close out the year, I want to thank each of you for your contributions, not only to the Association, but to the families we serve. Whether you are a builder, supplier, trade partner, or associate member, your commitment to excellence and professionalism keeps our industry strong.

Let us continue to support one another, stay informed, and advocate for policies that protect and promote housing in our region. Together, we will navigate these challenges and look forward to an even stronger 2026.

Thank you again for making this year one of progress, teamwork, and resilience.

|

Executive Message • RAY ADAUTO

Are you ready for 80?

As we get ready for the 79th installation of new leadership and the board we are reminded that we are entering our eightieth anniversary in 2026. Eighty years is a big deal, no matter whether its years are alive, or the age of your car, or the age o your organization. For the association it marks how many years ago we were born. 1946 had just begun to welcome war veterans and wartime workers back into civilian life and jobs, with families needing housing. El Paso and surrounding communities had played a key role in the war effort, and those workers were ready to buy a house. So celebrating our anniversary of our eightieth birthday will be a big deal if for no other reason than being relevant for all these years. Our members are why we continue to be a voice of housing and business in El Paso.

The federal government shutdown is having an impact and none of it good. We are a divided and fractionalized country right now, worse than during civil rights or Vietnam war years. Having the shutdown now jeopardizes a very razor thin calm, but I fear there is a short fuse that media and the internet are participating in that changes the playing field. I believe in your citizenship rights and the rules of laws. Some intelligent people are suddenly stupid. Case in point is how New Yorkers seem destined to select a communist for mayor. I suppose that his talks of free this and that sound appealing to those who have little or nothing, but I also think that if he’s elected the warnings from the past will come true. The United States is a mishmash of cultures because we assimilated into being American, today legal, and undocumented immigrants want to be in America without being American. That’s not how this Republic works. Yet even elected officials seem to not recall those principles we built this country on. The silence, I fear, will erupt one day. It will not be pretty. We can take that first step to curtail this fear by demanding our government return to work, pay the workers and help those in need. It’s time

|

|

Why Builders Overpay for Land and How to Protect Your Margins

NAHB

Land is the single largest cost driver in any home building project. But even experienced acquisition teams sometimes overpay. This often comes down to a lack of context and outdated data.

1.Lagging and Limited Transaction Data

Relying on public records to track land sales comes with inherent risks: lagging or incomplete data, inconsistent reporting across jurisdictions, and blind spots in partial or non-disclosure states.

Without access to comprehensive and accurate comparables, teams risk building models on outdated assumptions. This leaves room for inflated valuations and thinner margins.

2.Hidden Builder and Investor Activity

Knowing who’s buying nearby and why is one of the most strategic advantages in land acquisition.

Too often, that visibility is missing. Builder and investor activity is frequently hidden behind shell entities and LLCs, making it difficult to connect individual parcels to real market behavior. Without that clarity, acquisition teams risk misreading local momentum, entering over-saturated markets, or missing the early signals of builder expansion that drive future pricing.

3. Finding the Right Parcels from the Start

Overpaying often begins when teams spend too long evaluating parcels that don’t fit their criteria. Every round of misaligned due diligence delays capital deployment and reduces leverage.

By the time the right opportunity surfaces, competitors may already be active, driving up prices and shrinking inventory. Inefficient parcel discovery doesn’t just waste time; it forces teams to enter markets late, where urgency and scarcity push land costs higher.

4.Understanding the Full Context of Every Site

Even the right parcel can be the wrong deal if you don’t have the full picture.

Hidden costs like flood risk, poor utility access, or challenging topography can turn a fair price into an expensive project. Consolidating all site details — zoning, utilities, infrastructure, environmental risk and ownership — into a single view helps teams vet opportunities faster and avoid costly surprises later.

5.Turning Information into Action Across Teams

Land data only drives value when it’s shared, visualized and acted on across your entire team.

Centralizing deal information across departments creates accountability and alignment. When everyone is working from the same source of truth, teams can analyze markets collaboratively, track performance, and defend every acquisition decision with confidence.

6.Building with Complete Land Intelligence

The margin for error on land decisions is shrinking. Avoiding these pitfalls requires connected, current land intelligence across your entire team.

Acres delivers complete land intelligence. It connects up-to-date land data, market intelligence, and portfolio visibility in one platform so your team can value land confidently — before competition and pressure drive prices higher.

|

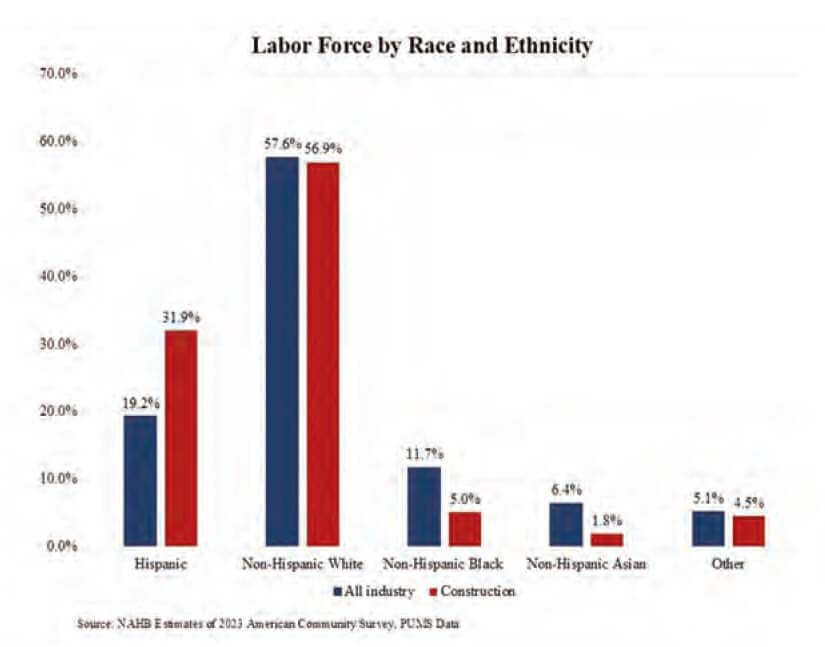

How Diverse is the Construction Workforce?

NAHB

Diversifying the construction labor force remains a key priority amid persistent skilled labor shortages.

According to the 2023 American Community Survey, non-Hispanic White workers still account for the majority of the construction industry at 57%. Hispanic workers now represent nearly one-third of the labor force at 32%, followed by non-Hispanic Black workers at 5% and non-Hispanic Asian workers at 1.8%.

The most notable trend in construction labor force has been the steady rise of Hispanic participation. Between 2010 and 2023, the number of Hispanic workers in construction increased from 2.5 million to almost 3.8 million. Over the same period, their share of the labor force climbed from

23.6% to 32%, meaning that nearly one in three construction workers today is Hispanic.

Hispanic workers comprise a larger share in the construction than the broader economy, making up 31.9% of the construction labor force compared with 19.2 % across all industries. Non-Hispanic White workers account for 57.5% of the construction labor force, about the same as their share across all industries at 58.3%. Black and Asian workers, by contrast, remain underrepresented in construction.

See a state-by-state breakdown of Hispanic workers in construction in this Eye on Housing post from NAHB Principal Economist Na Zhao.

Powerless Pricing

September CPI came in relatively tame at 0.3% M-o-M, while all-important core inflation was just 0.2% M-o-M, its lowest reading since June. Both were up 3% Y-o-Y. Shelter inflation is finally falling, tariffs remain hard to discern, and services (think immigration crackdown) rose just 0.2% M-o-M, good news. Critically, there is no sign of an inflationary breakout. A 25bps Fed rate cut on 10/29/25 at 2pm ET is assured.

Passport Power

The Friday File: The nation with the passport that allows entry into the most destinations visa-free is Singapore at 193 out of a possible 227. South Korea follows at 190, then Japan at 189. The US is tied for 37th spot with Malaysia at 180. By comparison, Canada is in 32nd spot, and the UK is in 26th with visa-free entry into 184 destinations. Afghanistan is last at 24.

States' Status

A recent study trying to mimic what the Business Cycle Dating Committee looks at when determining if the economy is in recession finds 22 states, representing 33% of GDP, in or at high risk of recession. Their problems are due to weak immigration, rising tariffs and federal job cuts, and are more generally exposed to agriculture/manufacturing. 12 states including CA/NY are neither growing or contracting, and 16 including FL/TX are growing.

Job Jeopardy

While we haven’t seen large numbers of layoffs, monthly hiring is at its lowest level since 6/15, and at the lowest percentage since 3/13. Similarly, job postings on Indeed.com are at their lowest since 2/21. When workers are asked if jobs are “plentiful” or if they’re “hard to get”, the Plentiful-Hard to Get gap was +8 points. Pre-Covid it was +40. American workers are rightfully nervous about losing their jobs.

Beijing Battles

While Chinese exports to the US slid 17% during Jan-Sept, they increased 6.1% elsewhere. However, China still faces serious economic issues amid hardball US trade talks. Q-o-Q 25Q3 GDP growth was 4.8%, but was 5.2% in 25Q2, and 5.4% in 24Q4 and 25Q1. And on a Q-o-Q sequential basis, growth decelerated to 3.5% in 25Q3 from 4.3% in 25Q2, 5.6% in 25Q1 and 6% in 24Q4. China’s slowing and decoupling.

Smartphone Story

The Friday File: Kids are now growing up fast and are probably already asking ChatGPT to tell them a bedtime story. As for old fashioned smartphones, 8% of parents report that their children under five have their own smartphone. That percentage rises to 12% for kids ages 5-7, 29% for offspring 8-10, and 57% for progeny 11-12. I didn’t get my own cell phone until age 35. Very protective parents!

Troubled Tourism

If there was a common thread in last week’s Fed Beige Book, a purely anecdotal and quantitative report put out eight times/year, it was the declining fortunes of the formerly hot US travel/leisure/hospitality sector. To wit, the decline in international (read Canadian) tourism was cited on several occasions. Mention was also made of the increasing reluctance to spend on the part of low- and middle-income consumers who are increasingly stretched.

Policy Puzzle

The US economy has, to date, performed substantially better than many expected despite tariffs and many other unorthodox policies and interventions coming from DC. There are numerous reasons why. They include falling interest rates, strong corporate earnings, a belief that sharp market swings will reverse some policies, optimism about technology and AI, and the fact that populist policies when enacted (particularly in LatAm) have relatively good short-term outcomes.

Bank Bonanza

25Q3 bank earnings were a stunning $50 billion, up 20% Y-o-Y! All divisions did well, including wealth management, lending, trading and M&A/investment banking, suggesting a healthy economy. But not so fast. The drivers were big firm borrowing for M&A, and affluent households borrowing against booming equity values. Middle-class deposits grew, but Main Street borrowing and household credit card growth were minimal. The wealthiest households and biggest firms are driving results.

Odd Outcome

While some forecast 25Q3 growth as high as 3.8%, this is undoubtedly due to booming EV sales ahead of the $7,500 tax credit that ended 9/30 and probably a sizable decline in net imports due to tariffs. The negative ADP and LinkedIn employment reports, the seventh straight month of declining manufacturing activity, a stalling service sector, and probably very weak future car sales hardly scream strong growth.

Elliot Eisenberg, Ph.D. is an internationally acclaimed economist and public speaker specializing in making economics fun, relevant and educational. Dr. Eisenberg earned a B.A. in economics with first class honors from McGill University in Montreal, as well as a Master and Ph.D. in public administration from Syracuse University. Eisenberg is the Chief Economist for GraphsandLaughs, LLC, a Miami-based economic consultancy that serves a variety of clients across the United States. He writes a syndicated column and authors a daily 70-word commentary on the economy that is available at www.econ70.com.