Vol. 2025, Issue 9 - Builders Outlook

Home sales to jump nearly 10% in 2026

Home sales to jump nearly 10% in 2026

https://www.realestatenews.com/

A Fannie Mae forecast group is becoming more bullish in its prediction that 2026 will be the year home sales finally bounce back.

The organization's Economic and Strategic Research Group now forecasts overall home sales — new and existing — will be 9.2% higher at the end of 2026 compared to the end of 2025. Existing home sales are expected to be at an annualized rate of 4.446 million at the end of 2026, up 9.6% compared to forecasts for the end of this year.

While the September 2025 Economic and Housing Outlook is similar to predictions researchers made back in June for 2026, it is more hopeful than their February forecast, which anticipated a 6.1% overall increase and a 6.7% rise in existing home sales next year.

The group also forecasts a steady decline in 30-year mortgage rates, which have fallen in recent weeks. It expects the rate to be at 6.4% by the end of 2025 and 5.9% by the end of 2026.

What's needed for a market resurgence?

A market rebound will depend largely on improving financial conditions in the housing market, said Odeta Kushi, deputy chief economist at First American.

"In 2026, modest improvements in affordability — driven by rising inventory, moderate price growth, and potential mortgage rate relief — could support a gradual rebound in home sales," Kushi said in an email.

"While financial conditions are a key part of the equation, lifestyle factors like the five D's (diplomas, diapers, divorce, downsizing, and death) will continue to play a major role in driving housing decisions, regardless of market dynamics," Kushi added.

For real estate agents, it's been a long slog. The last time the annualized rate for existing home sales was in the 4.5 million range was October 2022 — and there have been several months since then when the rate was below 4 million.

First-time buyers still aren't catching a break

Affordability remains one of the reasons that home sales are expected to hit a 30-year low by the end of 2025. According to First American's Sept. 23 First-Time Home Buyer Outlook Report, only 26% of homes were affordable for median renters in the second quarter of 2025 — down from 28% in late 2024.

Released weeks after the start of the NFL season, First American's report broke down affordability for first-time buyers by NFL divisions. The AFC South (Jacksonville, Florida; Indianapolis; Houston; Nashville, Tennessee) placed first with 26% of homes affordable for the median renter. The NFC West (Phoenix; Seattle; San Francisco; Los Angeles) was last with just 8% of homes affordable for the median renter.

But the affordability picture is changing — and that could lead to the jump in home sales that Fannie Mae forecasters expect.

"Mortgage rates have moderated, incomes continue to rise and house price growth is slowing — all signs that the affordability chains may be moving in the buyers' favor," said Mark Fleming, chief economist at First American.

Resiliency

El Paso Home builders carry on despite challenges

As we move into the final quarter of the year, the El Paso housing market continues to show resilience despite a variety of economic pressures. While national headlines focus on volatility, here in El Paso we are seeing strong demand for new homes, especially from first-time buyers and families relocating for work or military assignments.

One of the most talked about developments recently is the Federal Reserve decision to begin lowering interest rates. This shift, after a prolonged period of high rates meant to curb inflation, offers a breath of fresh air to both buyers and builders. For homebuyers, even a modest reduction in rates can mean the difference between qualifying for a mortgage or being priced out. For us as builders, this change brings a potential uptick in buyer confidence and movement in the market. However, it is important to remember that supply chain issues and labor shortages still pose significant challenges. While some material costs have stabilized, others such as concrete and electrical components remain high or difficult to source.

Locally, El Paso continues to experience a housing shortage. Inventory remains tight, which puts pressure on affordability and accessibility. As an association, we are working with city officials to streamline permitting and push for responsible growth that balances neighborhood concerns with the urgent need for housing.

Despite the challenges, I remain optimistic. Our builders, subcontractors, and suppliers have shown incredible resilience, and our community demand for quality housing is strong. As president of the El Paso Association of Home Builders, I am proud to represent an industry that literally builds the future of our city.

Let us keep building stronger, smarter, and together.

|

Executive Message • RAY ADAUTO

Challenges Continue

Our country and our industry face economic, social issues

September has shown itself to be a difficult month for interest rates, higher food prices, war, and political discord.

The Fed only dropped interest by twenty-five bases points, a ridiculously small, almost in-your-face drop. No one was happy, certainly not the builders or agents. At some point the Fed is going to have to stop keeping the rates high when all indicators are pointing differently.

On the economy, the price of food continues to be high, and that unfortunately is hurting people at home and in restaurants. I have noticed that while eggs dropped in price other commodities rose, killing any noticeable food price abatement.

Fuel, as I measure it from the pumps of Costco continue to baffle me. One week the price is down five or more cents a gallon, the next week up fifteen cents. This is especially true over the weekend into the following Monday. It’s like getting gasoline from a pirate ship, the cost depends on the wind.

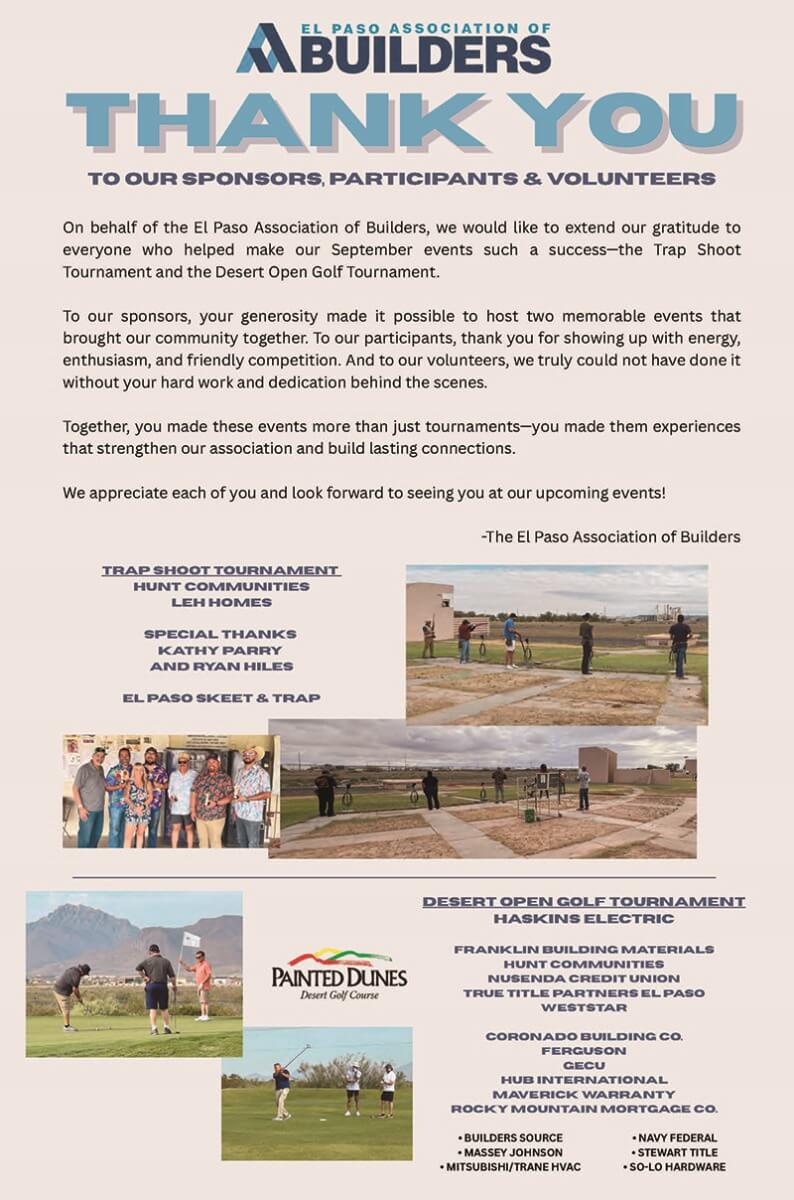

I would like to thank everyone who sponsored or participated in our trap shoot and golf tournament. We learned some valuable lessons with both and hope to offer you a better experience in next year’s events.

Our next general meeting is October 9, at the Dave & Busters located in Bassett Place near Costco. Yes, it’s a first time visit there for a meeting, yes, it is for reals, and yes, we will have some fun AFTER the meeting. Make your reservation now.

Finally, I want to say how sad the killing of Charlie Kirk has been for me. And not necessarily for what you think I’m sad about even though taking someone’s life is murder plain and simple. What died as well is the ability to have discussions and open dialogue. I may not agree with what you’re saying but I agree to defend your right to say it so long as it’s not yelling fire in a crowd, or inciting a riot, or violating laws. Kirk took the bullhorn to talk, even his enemies agreed that.

|

|

New Home Sales Post Unexpected Large Gain

NAHB

A modest drop in mortgage rates led to a surprisingly large jump in new home sales in August that could be revised lower next month.

Sales of newly built single-family homes jumped 20.5% higher in August, to a seasonally adjusted annual rate of 800,000 from an upwardly revised reading in July, according to newly released data from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. The pace of new home sales is up 15.4% from a year earlier. The three-month moving average of new home sales was 713,000, an increase from the 656,000 in July. New home sales remain down 1.4% on a year-to-date basis.

“New home sales experienced a significant surge in August, while builder confidence held steady at a low reading in September,” said Buddy Hughes, chairman of the National Association of Home Builders (NAHB) and a home builder and developer from Lexington, N.C. “While this month’s figure may be subject to downward revision, we do expect a general improvement in sales over the coming months, supported by the recent decline in mortgage rates.”

“According to Freddie Mac, the average 30-year fixed mortgage rate has declined by 32 basis points over the past four weeks and now sits at 6.26%—its lowest level since early October 2024,” said Jing Fu, NAHB senior director of forecasting and analysis. “This downward trend in rates, combined with the recent Fed interest rate cut, signals a positive outlook for future housing demand. If this momentum continues, we expect new home sales to gain traction as more buyers reenter the market in the final quarter of 2025.”

A new home sale occurs when a sales contract is signed, or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the August reading of 800,000 units is the number of homes that would sell if this pace continued for the next 12 months.

New single-family home inventory declined for the third straight month to 490,000 residences marketed for sale (of all stages of construction) as of August. This is 1.4% lower than the previous month and 4.0% higher than a year earlier. At the current sales pace, the months’ supply for new homes was 7.4 compared to 8.2 a year ago.

The median new home sale price was $413,500, up 1.9% from a year ago.

New home sales have also been buoyed by home builders use of incentives. Recent NAHB survey data shows 37% of builders reported cutting prices in August and 66% reported using sales incentives.

Regionally, on a year-to-date basis, new home sales are down 22.0% in the Northeast, 3.9% in the Midwest and 7.3% in the West. New home sales are up 3.3% in the South.

|

What the Fed Rate Cuts Mean for Housing and the Economy

NAHB

After keeping rates steady through most of 2025, the Federal Reserve’s monetary policy committee (FOMC) voted at its September meeting to cut its key interest rate by 25 basis points, bringing the target federal funds rate down to 4.25%.

Fed Chair Jerome Powell called it a “risk management cut” — a move meant to guard against growing uncertainty, rather than a response to a clear economic downturn. The decision follows signs of a cooling job market and moderating inflation. Job growth has slowed, unemployment has edged up (though it remains low), and inflation, while still above target, has been relatively contained.

Markets expected the move, and much of the impact was already priced in. Mortgage rates, for example, have already dropped slightly, with the average 30-year fixed now at 6.35%, down 20 basis points over the past month. The 10-year Treasury yield barely moved after the Fed’s announcement, reflecting how little surprise the decision carried.

Impact on Housing

The rate cut will have a direct, beneficial impact on builders, especially those relying on acquisition, development, and construction (AD&C) loans. These loans are key to getting new homes built, particularly by private builders, who construct more than 60% of the country’s single-family homes. Lower borrowing costs for builders could help ease housing supply constraints across the country.

However, Powell acknowledged that the housing market remains weak and noted that many of the issues — such as high regulatory costs and a persistent housing shortage — can’t be solved by monetary policy alone. Still, the Fed’s actions should offer some relief on the financing side.

Slowing Economic Growth Ahead

The broader economic outlook points to slower growth moving forward. The Fed projects GDP will grow just 1.6% in 2025, with a slight increase in unemployment to around 4.5%. Inflation is expected to gradually decline, but the Fed doesn’t see its 2% target being met until 2028 — highlighting how persistent inflation pressures continue to be.

Overall, while this rate cut was expected, it signals a shift in tone. The Fed is opening the door to further easing, but as Powell emphasized, future moves

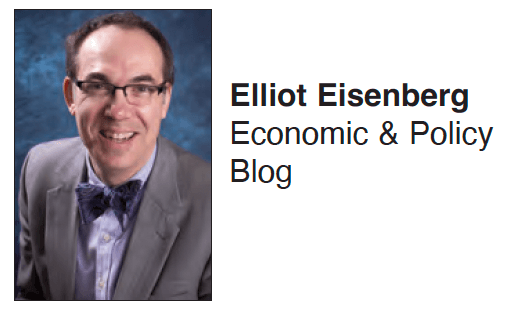

Regular Reporting

There is currently movement to end the quarterly reporting requirement by public firms and replace it with semi-annual reporting. It’s argued this will reduce administrative costs and discourage short-term thinking. But six months is hardly long-term, and in the UK, where firms needn’t report quarterly, the stock market is shriveling and most firms still report quarterly. The reason is more frequent reporting leads, for many reasons, to lower capital costs.

Definitely Demand

With suddenly weak job growth, there is some debate about whether this is due to a lack of demand for workers by firms or a lack of supply due to new immigration policies. Make no mistake, it’s primarily declining labor demand. Job openings, job findings, the percentage saying jobs are plentiful, and other metrics are all deteriorating. Annual wage growth is also slowing. These are all signs of softening demand.

Fidgeting Fed

Unsurprisingly, the Fed reduced rates 25bps. What’s surprising; one FOMC member, its newest, sees more than 50bps in cuts this year, nine expect two 25bps cuts, two see one cut, and seven see none. The median is two cuts, but the dispersion is gigantic. It’s because equity markets are setting records, inflation is rising, and OBBBA tax cuts will be stimulative. However, the labor market weakens. A mildly/slightly hawkish cut.

Equity Analysis

An economic slowdown paired with rate cuts, absent a profit recession, is great for equities. Even if earnings multiples compress, falling borrowing costs and resilient earnings support stocks. A weaker dollar adds another lift. Corporations can further boost ROE by leveraging balance sheets, as long as sales-to-assets and earnings-to-sales hold. In that case, easing monetary policy improves shareholder returns even with flat top-line growth. This is why equities are rallying.

Excellent Equity

While mortgage debt is up $2.88 trillion from the Housing Bubble peak, as a percentage of GDP it’s 44.6%. During the Housing Bubble, that percentage exceeded 70%. Better yet, the last time mortgage debt as a percentage of GDP was 44.6% was 2000. Back then household real estate values as a percent of GDP was 120%, today it’s 160%. This means most homeowners have large equity cushions in their homes.

Financial Flight

Last year, American, Delta, United, and Southwest posted a combined $12 billion passenger operating loss but still recorded $13.5 billion in net profits. While freight helped, loyalty programs that bind customers to airlines and airline credit cards were primarily why. In 2Q25, Delta received $2.1 billion, American $1.4 billion, and United $800 million from AmEx, Citigroup, and JPMorgan Chase for miles awarded to bank/airline credit card holders.

Payroll Problem

The BLS annual preliminary payroll benchmark revisions, based on state government unemployment insurance data, showed a huge 911,000 downward revision to employment growth for the year ending 3/25. This means the economy was slowing before Trump entered office, and that monthly employment growth was not 147,000/month but was 70,000/month! Ideally, it would be good to get better/quicker state data and stop with the surveys. The Fed cuts 25bps next week.

Edgy Employment

August net job growth was dismal at 22,000, with June and July revised down by 21,000 combined. In CY24, job growth averaged 167,000/month, but in the four months since Liberation Day it’s averaged 26,750/month. Of 511,000 private jobs created in 2025, 453,000 were in social assistance and healthcare. A 25bps September cut is all but certain; the key question now is how quickly and deeply the Fed will move thereafter.

Crude Confusion

OPEC+ has been generally increasing oil production to gain share after reducing supply earlier. However, with global GDP growth slowing, there’s concern demand will not materialize, inventories will grow, and higher production will reduce prices. To date however, inventories have not risen, as growth has surprised and China’s been increasing reserves. Thus front-month contracts remain in backwardation, with supply tight, and not contango – when future-dated

Elliot Eisenberg, Ph.D. is an internationally acclaimed economist and public speaker specializing in making economics fun, relevant and educational. Dr. Eisenberg earned a B.A. in economics with first class honors from McGill University in Montreal, as well as a Master and Ph.D. in public administration from Syracuse University. Eisenberg is the Chief Economist for GraphsandLaughs, LLC, a Miami-based economic consultancy that serves a variety of clients across the United States. He writes a syndicated column and authors a daily 70-word commentary on the economy that is available at www.econ70.com.