Vol. 2026 - Issue 1 - Builders Outlook

NAHB Urges Congress to Ease Regulatory Burdens

NAHB Urges Congress to Ease Regulatory Burdens

Testifying at a congressional panel hearing focusing on housing affordability, Buddy Hughes, chairman of NAHB and a home builder and developer from Lexington, N.C., said that in order to ease housing constraints for home buyers and renters, it is imperative to eliminate excessive regulations that hinder the construction of new homes and apartments.

“Regulations account for nearly 25% of the cost of a single-family home and more than 40% of the cost of a typical apartment development,” said Hughes. “The time and costs associated with complying with a multitude of government regulations can be significant for small- and medium-sized builders and ultimately limit housing supply.”

Increased regulations, including overly stringent mandatory energy code requirements, are impeding the ability of builders to boost housing production. In particular, Hughes cited an April 2024 final determination by the Department of Housing and Urban Development (HUD) and the U.S. Department of Agriculture (USDA) that required new single-family and multifamily homes financed by these agencies to comply with the 2021 International Energy Conservation Code (IECC) or ASHRAE 90.1-2019, respectively. The Trump Administration has delayed the effective date for both single-family and multifamily housing until May 2026.

“NAHB urges Congress and the administration to prohibit HUD and USDA from enforcing a minimum energy standard that increases housing costs during a nationwide affordability crisis,” said Hughes. “We also urge policymakers to respect state and local authority over code adoption and to reject mandates that most states have not determined are appropriate for their communities.”

For multifamily projects with federal assistance, a key challenge for builders and developers is the requirement to source domestically for construction.

“While our members try to use products made within the U.S., it’s not always practical because of price or availability,” said Hughes. “Multifamily housing needs an exemption from this requirement to help avoid construction delays and additional costs.”

Hughes also cited labor regulations such as the Davis-Bacon Act, which add to housing costs by requiring prevailing wage rates for construction projects. These are based on union wage rates that do not reflect local market conditions. On top of higher labor costs, builders face extensive paperwork, weekly payroll certifications, and compliance risks. Even a minor or technical mistake can result in major financial penalties.

“NAHB looks forward to working with policymakers to enact sensible regulatory reforms to help break the rising housing cost curve and allow builders to produce more attainable, affordable housing,” said Hughes.

President's Message

Building Momentum for 2026

As we begin a new year at EPAB, I am grateful for the opportunity to serve as your 2026 President and to work alongside such a dedicated group of builders, associates, and industry partners. The El Paso building industry, like the national market, continues to navigate rising costs, labor challenges, regulatory pressures, and ongoing affordability concerns. Yet even in this environment, our industry remains resilient, innovative, and essential to the strength of our local economy.

During my installation, I outlined three key objectives for 2026. First, we are focused on increasing EPAB membership to help TAB reach its goal of returning to pre-pandemic membership levels of 10,000 members statewide. Second, we are committed to increasing awareness of the importance of contributing to HOMEPAC, TAB’s political action committee, which plays a vital role in protecting our industry through effective advocacy. Third, we will continue to champion the women in our industry by expanding and strengthening EPAB’s Professional Women in Building (PWB) Council.

We did not waste any time getting started. At our first board meeting of the year, we formed seven committees and appointed committee chairs to support these and other EPAB initiatives. These include committees dedicated to a membership drive, a HOMEPAC fundraising event, and an event to celebrate EPAB’s 80th anniversary. Committees have already begun meeting, and momentum is strong. Our PWB Council also started the year with energy, planning a Galentine’s Dinner and meeting that will offer a fun opportunity to connect, socialize, and network.

I sincerely thank all board members who volunteered their time and leadership, and I encourage all members to support these efforts by attending and participating. Together, we can continue to strengthen EPAB as a resource, an advocate, and a unified voice for our industry.

|

Executive Message • RAY ADAUTO

Immigration enforcement

Our industry must remain true to the law

I want to state the obvious first. We live in a country of laws, some good, some controversial, some that affect us, and some that might not. According to American Judicial System.org “Law is a system of rules that are created and enforced through social or governmental institutions to regulate behavior. It is a fundamental aspect of any civilized society, providing the framework within which individuals and entities operate.”

Recently I was contacted by a local media outlet concerning the recent ICE actions in Horizon and Santa Teresa. The reporter asked me a question that made me hesitate and not fall into a trap. “Ray, what is the protocol with respect to ICE raids on the workplace?”

I stayed quiet trying to interpret what this reporter may be asking, and whether or not the reporter understood what was being asked. I replied that the only protocol is to obey the law. The reporter was confused with my response and tried to restructure it. “What do you tell your builders to do?” What? My response was the same, follow the law.

I am not a lawyer, but I have to say what we have always said. As a business you cannot take unnecessary risks and not following the law ranks pretty high up there. The immigration law says you must be of legal status (including having work permit) if you work in the USA. Every country has similar laws. I recall a very close friend who worked on board a yacht in Mexico without the correct permit and was arrested and expelled from Mexico with a big fine. It happens around the world because societies need rules or there would be chaos. I had heard of one contractor who told his crew to hide in a house and lock the doors because they would post no trespassing signs. Really? Ignorance is Bliss, but it could be very painful.

`We have said for a very long time that there needs to be immigration reform to allow workers access to jobs and legal immigration. The reality is that ICE has a lawful job under our government. As an industry we must obey the law, work to change those we think need changing, and most importantly protect our businesses and families. I would also suggest that you consult legal advice if you are unsure. Ignorance of the law is not an excuse. Don’t get caught up in the emotion. Stay safe.

|

|

Mortgage Rates Tick Higher, But Remain Low

The average long-term U.S. mortgage rate ticked higher this week, but remains near its lowest level in more than three years.

The average long-term U.S. mortgage rate ticked higher this week, but remains near its lowest level in more than three years.

The benchmark 30-year fixed rate mortgage rate rose to 6.09% from 6.06% last week, mortgage buyer Freddie Mac said Thursday. One year ago, the rate averaged 6.96%.

Borrowing costs on 15-year fixed-rate mortgages, popular with homeowners refinancing their home loans, also rose this week. That average rate inched up to 5.44%, up from 5.38% last week. A year ago, it was at 6.16%, Freddie Mac said.

Mortgage rates are influenced by several factors, from the Federal Reserve’s interest rate policy decisions to bond market investors’ expectations for the economy and inflation. They generally follow the trajectory of the 10-year Treasury yield, which lenders use as a guide to pricing home loans.

The modest increase in rates this week follows a jump in the 10-year Treasury yield as the bond market reacted to geopolitical tensions over tariff threats by the Trump administration as it pressed for control of Greenland and turbulence in Japan’s bond market.

The 10-year yield was at 4.27% at midday Thursday, up from 4.17% a week ago.

The U.S. housing market has been in a sales slump dating back to 2022, when mortgage rates began to climb from pandemic-era lows. The combination of higher mortgage rates, years of skyrocketing home prices and a chronic shortage of homes nationally following more than a decade of below-average home construction have left many aspiring homeowners priced out of the market. Sales of previously occupied U.S. homes remained stuck last year at 30-year lows.

Uncertainty over the economy and job market are also keeping many would-be buyers on the sidelines.

Still, a pullback in mortgage rates that began late last summer helped give sales of existing U.S. homes a boost toward the end of last year. In December, sales jumped 5.1% from the previous month.

As mortgage rates have eased, more homeowners have sought to refinance their existing home loan to a lower rate.

Applications for mortgage refinancing loans jumped 20% last week (January 19) from the previous week and accounted for nearly 62% of all home loan applications, according to the Mortgage Bankers Association. Applications for loans to buy a home rose 5%.

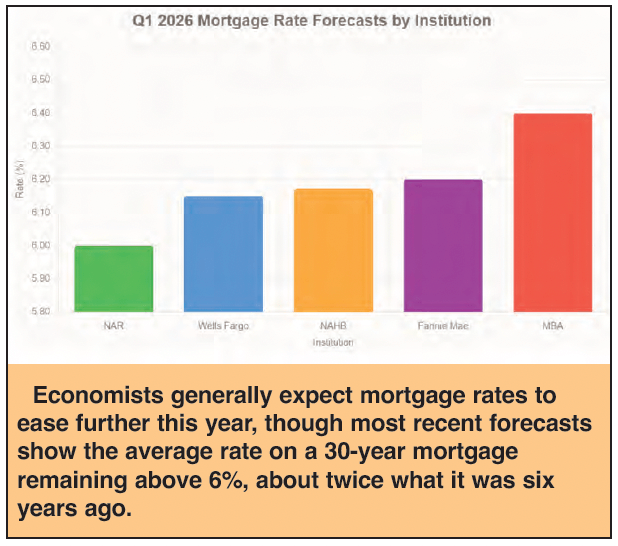

Economists generally expect mortgage rates to ease further this year, though most recent forecasts show the average rate on a 30-year mortgage remaining above 6%, about twice what it was six years ago.

Still, rates would have to drop considerably for homeowners, who bought or refinanced when mortgage rates hit rock bottom earlier this decade, to take on a new loan at a far higher rate.

Nearly 69% of U.S. homes with an outstanding mortgage have a fixed-rate of 5% or lower, and slightly more than half have a rate at or below 4%, according to Realtor.com.

Changes in the OBBBA to Lower Your Taxes

The 2026 tax season officially opens Monday, Jan. 26, as the IRS begins to accept and process 2025 tax returns. Tax returns are due by April 15, 2026.

This tax filing season brings several changes stemming from the One Big Beautiful Bill Act (OBBBA) that may lower your business or personal tax liability. In addition to blocking the $4 trillion tax hike that had been to set to occur starting in 2026, OBBBA includes important housing and business provisions that apply to the 2025 tax year:

For Businesses:

Full expensing (100% bonus depreciation) restored for business investments made after Jan. 19, 2025.

Increased Section 179 limits and phase-outs for small business expensing made effective for all of 2025.

The Section 460(e) Completed Contract rules expanded to include condominiums, in addition to single-family homes. This is a key tax accounting provision that ensures that home builders are not taxed on deposits paid by a buyer during construction of a single-family home. This bill extends the same tax treatment to deposits paid by condominium buyers during the construction phase, effective for contracts entered into after July 4, 2025.

For Individuals:

• Increased Standard Deduction: For 2025, the deduction increases to $31,500 for married couples filing jointly and $15,750 for single filers. These amounts are adjusted annually for inflation

• Enhanced Standard Deduction for Seniors: Effective for 2025 through 2028, individuals aged 65 and older may claim an additional deduction of $6,000 on top of the standard deduction. This deduction phases out for taxpayers with modified adjusted gross income over $75,000 ($150,000 for joint filers).

• Increased SALT deduction: The cap on state and local tax deduction (SALT) is temporarily increased from $10,000 to $40,000, effective for 2025 through 2029, with a 1% inflation adjustment after 2025. The increased cap phases out for households with incomes above $500,000, but the cap will not fall below $10,000.

• No Tax on Tips & Overtime: Up to $25,000 in tips and $12,500 in overtime ($25,000 for married filing jointly) are deductible for individuals with incomes under $150,000 ($300,000 married filing jointly).

Additional tax changes will kick in for 2026, including:

• An increase in the estate tax exemption,

• An increase in the 1099 reporting threshold, and

• The ability to deduct private mortgage insurance premiums.

|

ECONOMIC OUTLOOK

Duty Data

After comparing $4 trillion of international shipments to the US between 1/24 and 11/25, researchers find foreign exporters absorbed 4% of recent tariff increases, American consumers and importers absorbed the remaining 96%. This shows tariffs, as predicted by economic theory, are not a way to boost the wealth of nations imposing the tariffs. The $200 billion in added tariff revenue has raised prices, temporarily fueled inflation, and altered trade patterns.

Situational Status

If an economy is at full employment and enjoys stable inflation, wage growth will equal labor productivity growth plus inflation (LPG+I). If wages exceed LPG+I, unemployment is too low and inflationary pressure will build. If the opposite is true, there’s labor market slack and inflationary pressures will weaken. Wage growth is now 3.8%, and LPG+I is 4.6%, signaling modest excess labor supply even though the unemployment rate is just 4.4%.

Fed Fiasco

While unlikely, these outcomes are all possible: an indictment of Powell; an administration win in Cook v. Trump; Powell staying on the board after his Chair term expires; a Fed Board Chair vs FOMC Chair split; a Fed Chair loyal to the President; and a Fed Chair nominee being defeated in the Senate. The chances of even one of these outcomes occurring is quickly increasing and would give markets jitters.

Pad Prices

December median existing home sales jumped 5.1% M-o-M but just 1.4% Y-o-Y and remain near historic lows. A strong reason for any sort of sales bump is prices are falling. The median price has fallen for the second straight month, and in five of the past six. Moreover, new home prices fell 3.3% M-o-M in October, are down 8.8% Y-o-Y, and are at their lowest price since 7/21.

Bad Ban

To improve housing affordability, President Trump is considering banning large institutional investors from buying single-family houses. This is a bad idea. First, there are about 16 million rental homes in the US and large institutional investors own 2%. Second, the ban might reduce construction as a key source of demand disappears. Third, the fundamental reason housing is so costly is a lack of supply, solving that requires building more homes.

Fed Freedom

When economists were recently asked if giving the President more influence over monetary policy would lead to substantially worse monetary policy decisions, 80% strongly agreed, 14% agreed, 2% were uncertain, and 5% strongly disagreed. The reason is that elected officials are reluctant to raise rates and that unwillingness, as central bank history has repeatedly shown, results in systemically higher inflation. Central bank independence is the preferred way to overcome this.

Weaker Work

December job growth was a listless 50,000. Worse, October/ November growth was reduced by 76,000. While the unemployment rate declined, it did so only because the labor force participation rate fell. More generally, monthly job growth averaged just 29% of what it was in 2024, and if you strip out healthcare Y-o-Y job growth was zero. The labor market continues to gradually weaken. The Fed should cut rates in March.

Affordability Affront

To return home buyer affordability to its pre-Covid level, one of the following must happen: wages must rise 56%, lifting the median household wage to $132,000/year, the 30-year mortgage rate must fall 2.65% (assuming no resulting increase in home prices), or home prices need to slide 35%. Assuming a 19% rise in wages and rates falling to 3.85%, home prices would still need to fall 12%. Build homes!

Economic & Policy Blog

Elliot Eisenberg, Ph.D. is an internationally acclaimed economist and public speaker specializing in making economics fun, relevant and educational. Dr. Eisenberg earned a B.A. in economics with first class honors from McGill University in Montreal, as well as a Master and Ph.D. in public administration from Syracuse University. Eisenberg is the Chief Economist for GraphsandLaughs, LLC, a Miami-based economic consultancy that serves a variety of clients across the United States. He writes a syndicated column and authors a daily 70-word commentary on the economy that is available at www.econ70.com.